The recently proposed European Commission (EC) plan to tighten steel import quotas and tariffs may protect raw steel producers — but at a heavy cost to Europe’s downstream industries and circular economy ambitions, industry groups warn. According to an opinion released by Metal Packaging Europe (MPE), the new rules will hurt sectors that rely on thin-sheet steel (for example, packaging), driving up costs for everyday goods.

Specifically, MPE notes that imposing quotas and higher tariffs on the import of tinplate — the thin steel sheet widely used for food cans, aerosol cans, and similar packaging — could halve import volumes available to metal packaging manufacturers and sharply increase their costs.

Because many small and medium-sized enterprises (SMEs) depend on competitive prices and stable supply, these cost pressures are likely to ripple down to consumers, making items such as canned food, infant formula, pet food and household goods more expensive.

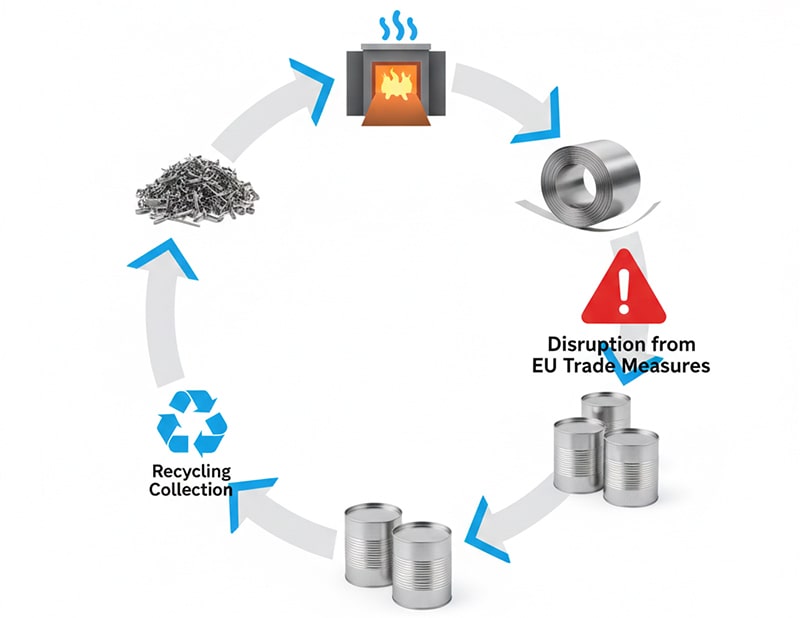

Europe’s metal-packaging sector is often cited as a success story in circular economy: steel packaging is highly recyclable, can be reused many times without loss of quality, and forms part of a working “steel scrap → new steel → packaging → scrap” loop.

MPE points out that this recycling-centric model is threatened by the new import restrictions — a paradoxical outcome given that the EU’s broader environmental strategy envisions boosting circularity and recycled content of metals.

In short: while the EC measure aims to shore up domestic steel production, it could undercut the viability of recycling-rich downstream industries that rely on affordable steel and abundant scrap flows.

| Indicator / Metric | Current Situation (before measure) | Risk After New Steel Measure |

|---|---|---|

| Recycling rate of steel packaging in Europe | ~ 82% | Recycling system intact — but under supply and cost pressure |

| Availability of imported thin-sheet steel for packaging users | Adequate to meet demand for cans, aerosols, etc. | Import volumes could reduce by roughly 50% (per MPE’s warning) |

| Cost pressure on SMEs downstream (packaging, consumer goods) | Relatively stable production/import costs | Higher raw-material costs + potential tariff burden ⇒ increased final prices for consumers |

The above numbers are based on MPE’s assessment of the impact of the proposed steel measures.

The EC’s wider policy background shows a stated commitment to boosting resource-efficiency, recycled content, and circular economy pathways in metals, including steel and aluminum — for example through the upcoming Circular Economy Act (expected 2026) and relevant reforms under the Steel and Metals Action Plan (SMAP).

Proponents of circularity argue that steel and aluminum — as "permanent materials" — are best placed to deliver sustainability: they can be recycled repeatedly without degradation, reducing demand for virgin raw materials and limiting environmental impact.

Yet the pending steel-import restrictions seem to run counter to these goals: by raising costs for recycled products and shrinking supply for downstream users, they risk undermining the circular economy rather than reinforcing it. This tension underscores a structural challenge: balancing industrial protection with environmental sustainability and supply-chain resilience.

MPE warns that the new steel measure “in its current shape and form” threatens to damage downstream manufacturing industries, particularly packaging — a sector that serves everyday consumer needs.

The packaging recycling ecosystem — long cited as exemplary in Europe — may lose competitiveness if steel becomes scarcer or more expensive, shifting dynamics away from circular models toward cost-driven substitution (e.g., plastics).

Critics of the measure argue that protecting only raw steel producers ignores the broader value chain: downstream users, recyclers, and consumers.

While the proposed steel import measure by the EU may help safeguard domestic raw-steel production in the face of global overcapacity and unfair competition, it carries serious risks for Europe’s downstream industries, recycling systems, and ultimately consumers. By constraining supply of thin-sheet steel, creating cost pressure, and destabilizing well-functioning recycling loops, the measure may hamper circular economy goals at a time when Europe is seeking to double down on sustainability, resource-efficiency, and industrial resilience.

For policy-makers: if the measure is adopted, it should be paired with protections for downstream sectors — for example, carve-outs for tinplate and steel packaging, support for SMEs, and safeguards for recycling supply chains.